How can we improve our parents cybersecurity?

Have you ever received a call from your mother asking, “Son, I got a text message saying I have to pay an extra 30 groszy for a package, but I didn't order anything. What should I do?” Or heard from your father that a well-known politician is promising huge sums of money on Facebook for a small investment in a state-owned company?

These are situations that make your blood run cold. The world is racing ahead, and our parents and grandparents, often less familiar with the technology they use every day, are becoming easy targets for cybercriminals. And we're not talking about complex hacker attacks straight out of the movies. We're talking about simple but extremely effective scams that play on emotions and trust.

The goal of this guide is not to turn seniors into cybersecurity experts. The goal is to make them safer than they are now. Below are some simple but proven steps you can take to become a digital guardian angel for your loved ones.

Table of Contents

Secure email - Gmail

If they don't have a Gmail account yet, it's worth setting one up for them. From a practical point of view, there is no better and free solution for a non-technical person.

Mailboxes on smaller, local portals often have weaker spam filters. As a result, they receive more fake emails about alleged invoices, lottery wins, or payment requests. In addition, such email providers earn money by delivering advertisements to their customers' accounts.

That's why you should set up a Gmail account for your loved one. Its filters are among the best in the world. They effectively filter out 99% of spam, phishing, and emails with malware. Anything that doesn't reach the inbox will not pose a threat.

Block ads

Now that we've gotten rid of spam, it's worth getting rid of ads. A huge proportion of attacks on non-technical people start with malicious banners.

Blingy pop-ups saying “Your computer is infected!”, sensational headlines about “miracle joint pain relief,” or promises of huge investment returns—these are all traps. One click can lead to a phishing site or virus installation.

Install an ad blocker, such as uBlock Origin. It is a free browser add-on (Chrome, Firefox, Edge) that will make most of this dangerous content simply disappear. Focus especially on blocking ads on Facebook and in Google search results, because that is where scammers most often catch their victims.

The CERT Polska team has prepared a special list of malicious domains. You can add it to AdBlock so that your loved ones do not visit websites that are already known to be dangerous. It's like an extra lock on the door. Link to the list: hole.cert.pl/domains/domains_adblock.txt

Banking and finance

Money and bank details are the main targets of cybercriminals. That is why it is so important to build solid, multi-layered security around them. The following steps will help you create a real financial fortress for your loved ones, minimizing risk and giving you a sense of control.

Let's start with a piece of advice that will probably raise the blood pressure of technical people, but in the case of seniors, it turns out to be an extremely effective lesser evil. It's about online banking passwords. The problem is that a senior citizen who knows their password can easily be tricked into entering it on a fake website that looks deceptively similar to the real bank website. The solution is to log in with a loved one on the real website and save the password in the browser, making sure that the senior citizen does not know it and will not remember it. The mechanism is simple: when they visit the authentic bank website, the browser will automatically fill in the details. However, if they visit a phishing website, the login fields will remain empty. This is an immediate and clear warning sign: “The website is asking me for my password, but the browser is not providing it? Something is wrong!” This approach has already saved many a household budget.

Yes, a password manager is definitely a better solution, but it can be problematic for seniors and non-technical people.

An even better and safer solution, which completely eliminates the risk of visiting a fake website, is to use the official banking app on your phone. Installed from an authorized store (Google Play or the App Store), it becomes a digital shield. Firstly, the app always connects directly to the real bank, so it is immune to fake links sent in text messages or emails. Secondly, logging in is usually done using secure biometrics – a fingerprint or face scan. Thirdly, many banks have introduced a call verification feature, displaying a notification in the app when someone from the bank is actually trying to contact you. This is a powerful tool to combat fraudsters impersonating bank employees.

However, even the best security measures can fail, which is why it is crucial to minimize potential losses. This is where payment card limits come in handy. If your card details are leaked, a thief may try to empty your account. To prevent this, it is a good idea to set low daily limits for online transactions and ATM withdrawals in your banking app. At the same time, you should explain to your loved ones that this is not an insurmountable barrier. If a larger purchase needs to be made, the limit can be easily and quickly raised for a short time and then lowered again after the transaction. On a daily basis, low thresholds are an excellent protective barrier.

The final piece of the financial puzzle is making payments online, which many seniors find daunting. It is worth showing them modern and secure methods. Teach them how to use BLIK, explaining that its strength lies in a one-time, six-digit code that expires quickly. Also explain the superpower of card payments, i.e., the chargeback mechanism. Thanks to this, if an online store does not send the paid goods, you can report the case to the bank, which will help you get your money back.

However, the gold standard for security is mobile payments such as Google Pay or Apple Pay. Once you add your card to your digital wallet, its actual number is never shared with the merchant during a transaction. Instead, a one-time encrypted code is used, making this method virtually impossible for fraudsters to intercept.

Buy them an iPhone

Today, smartphones are our command centers for the world, but unfortunately, they can also become gateways for fraudsters. Cheap, older Android phones, which often no longer receive security updates, are particularly vulnerable. All it takes is a moment of inattention and one click on a suspicious link for malware to be installed on them.

Added to this is the risk associated with paid text messages and premium numbers, which can easily trick an unsuspecting user. Fortunately, there are simple ways to turn your phone into a much safer fortress.

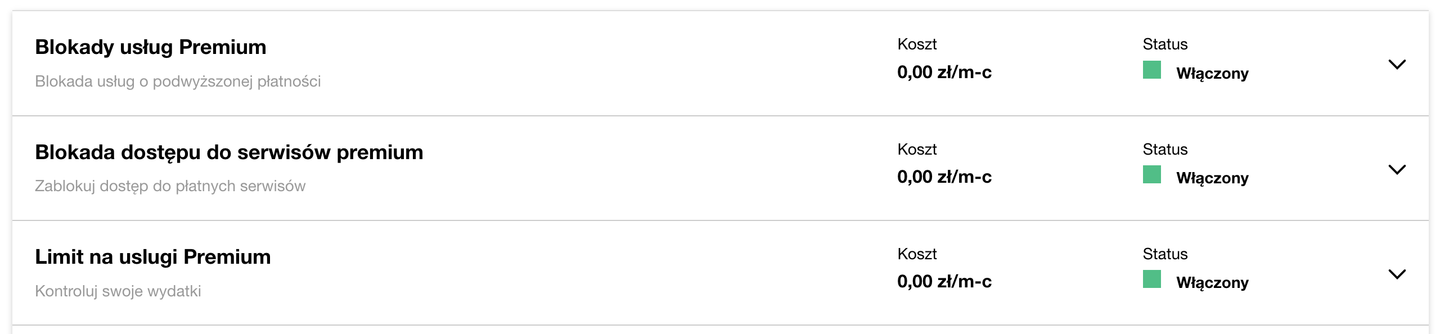

The first one costs nothing—just call your operator and ask for a complete block on paid premium services. This immediately closes one of the popular avenues for fraud.

The second step, if your budget allows, is to choose your device wisely. An older, used iPhone often proves to be a safer choice than a new, budget Android, as Apple provides security updates for up to 7 years. Consider purchasing, for example, an Apple iPhone SE. Its closed system makes it very difficult to install apps from outside the official store, which is a huge advantage when it comes to protecting seniors.

However, having a secure device is only half the battle. It is equally important to secure access to it, and a simple four-digit PIN code is not enough. It is easy to spy on it over someone's shoulder in a queue or on a bus, and stealing an unlocked phone gives a thief open access to the victim's entire digital life – contacts, emails, and even banking apps.

That is why setting up a biometric lock is absolutely essential. Both fingerprint (Touch ID) and facial recognition (Face ID) are unique security features that cannot be easily hacked. Finally, it is worth making sure that the screen locks automatically after a short period of inactivity, for example after one minute. This is a simple safety net that will work even if we forget to lock the phone ourselves.

Block your PESEL number

Our PESEL number is much more than just a string of eleven digits. It is our digital ID, the key to the most important services—from banking and healthcare to official matters. Unfortunately, nowadays, when data leaks from online stores, companies, and institutions are notorious, treating it as confidential information is extremely difficult. When this key falls into the hands of criminals, they can open the door to our financial life—take out a loan in our name from a parabank, sign a subscription contract for an expensive phone, or even rent an apartment, leaving us with debts and a legal nightmare to sort out.

Fortunately, there is a simple, free, and extremely effective defense tool provided by the state: the PESEL restriction service. It acts as a shield that prevents financial institutions from granting credit or loans to a restricted number. Helping a senior citizen activate this service is one of the most important things you can do for their safety.

There are several ways to do this, choosing the one that is most convenient for your loved one:

- The fastest way: The mObywatel app. If a senior citizen uses this app, blocking their PESEL number is literally a single click in the appropriate section.

- Via computer: The gov.pl website. The procedure is just as simple if you have a Trusted Profile and can log in to the government website.

- Traditionally: In person. What is extremely important for people who are less digitally savvy, the PESEL number can also be blocked in person at a bank branch, post office, or municipal office.

Importantly, the restriction is not a one-way ticket. If we need to take out a loan or complete other formalities requiring verification, we can easily revoke the restriction for a specified period at any time. This is a powerful barrier against fraudsters, which does not make our lives more difficult. Don't wait until it's too late – help your loved ones activate this digital shield.

Awareness and education

All of the tools and techniques described so far are extremely helpful, but the best and ultimate line of defense will always be people—their awareness and critical thinking. Technology is only a tool that can fail, but common sense, supported by knowledge of the threats, can stop even the most sophisticated fraud. The problem is that seniors often approach the internet with a great deal of trust, making it difficult for them to believe that someone could deliberately impersonate a well-known person, company, or institution. That is why it is crucial to patiently educate and repeat simple, practical rules that are even more important in the digital world: no one gives away money for free on Facebook, you cannot win contests you did not enter, and packages you did not order never require any additional payment. And the most important rule: a real bank employee will never ask you to provide your password over the phone.

This fundamental distrust is crucial, because fraudsters have become masters of manipulation. They often impersonate family members in trouble, police officers, postal workers, or energy company employees. They use time pressure, fear, and play on emotions so that the victim does not have a moment to think.

If you find it annoying to explain to your mother how to check her email, know that there is someone online who will patiently help her transfer her savings to your account.

That is why it is worth establishing a single, ironclad emergency procedure for every suspicious phone call or text message:

- Immediately end the conversation or ignore the message.

- Calmly consider whether the request makes sense and whether it seems suspicious.

- Contact the person or institution (grandchild, bank, police) yourself, using a phone number that you know and have saved, not the one that called you.

It is absolutely crucial never to call back the number provided by the scammer.

Perhaps the most difficult step is to extend this rule of limited trust to all information we encounter on the internet. We live in an age of misinformation, fake news, and sensational headlines that are created solely to provoke strong emotions and prompt us to act rashly. Encourage your loved ones to think critically and teach them the simple habit of verification. If a news story is particularly shocking or unbelievable, it is worth checking whether other well-known and respected news sites are also reporting it before sharing or believing it. Explain that they should never form an opinion based on the headline alone, as this is often the most misleading part. This is a skill that protects not only your wallet, but also your peace of mind.

Family password

What sounded like a science fiction movie script not so long ago is now becoming a reality. Artificial intelligence can now clone the human voice with remarkable precision. This means that a fraudster with access to a short sample of our grandchild's or daughter's voice (e.g., from a video posted on social media) can generate any statement that will sound 100% authentic. Soon, a phone call from a tearful “grandchild” asking for money to repair a car after an accident may be indistinguishable from the real thing. Our natural instinct to trust the voices of our loved ones becomes our greatest weakness at this point.

How can we defend ourselves against such advanced technology? The answer is surprisingly simple and requires no technical skills. The solution is to establish a secret family password—a funny, absurd sentence that only you know. It should be something that would never come up in normal conversation, for example: “Giraffes go into the closet,” “Yesterday it snowed purple,” or “Ducks like potato pancakes.”

Explain to your loved ones that in any emergency, emotionally charged situation, when someone calls asking for money, they should calmly ask for this password. A real family member will know it. A fraudster, even with a cloned voice, will be surprised, start to get confused, or try to exert pressure. Failure to provide the correct answer is an immediate and unambiguous signal that there is a criminal on the other end of the line. In such a situation, you should hang up immediately and, to be sure, call your grandchild yourself on their known phone number. It's a simple trick that puts control in your hands and builds an additional, invaluable layer of trust within the family.

Summary

Remember, these tips are not for you. They are for the people you love and whose safety in the digital world you want to ensure. Implementing these few steps will not turn your loved ones into experts, but it will build a solid protective wall around them that will repel most common attacks. It is an investment that pays off in peace of mind – both yours and theirs.

View related articles

Awarie IT zdarzają się każdemu

Od paru godzin trwa awaria komunikatora internetowego Slack. Kilka tygodni temu nie można było korzystać z usług firmy Google, a jeszcze wcześniej spora część Internetu nie działała z powodu awarii usług Cloudflare. Czy to możliwe, że usługi w chmurze są niedostępne?

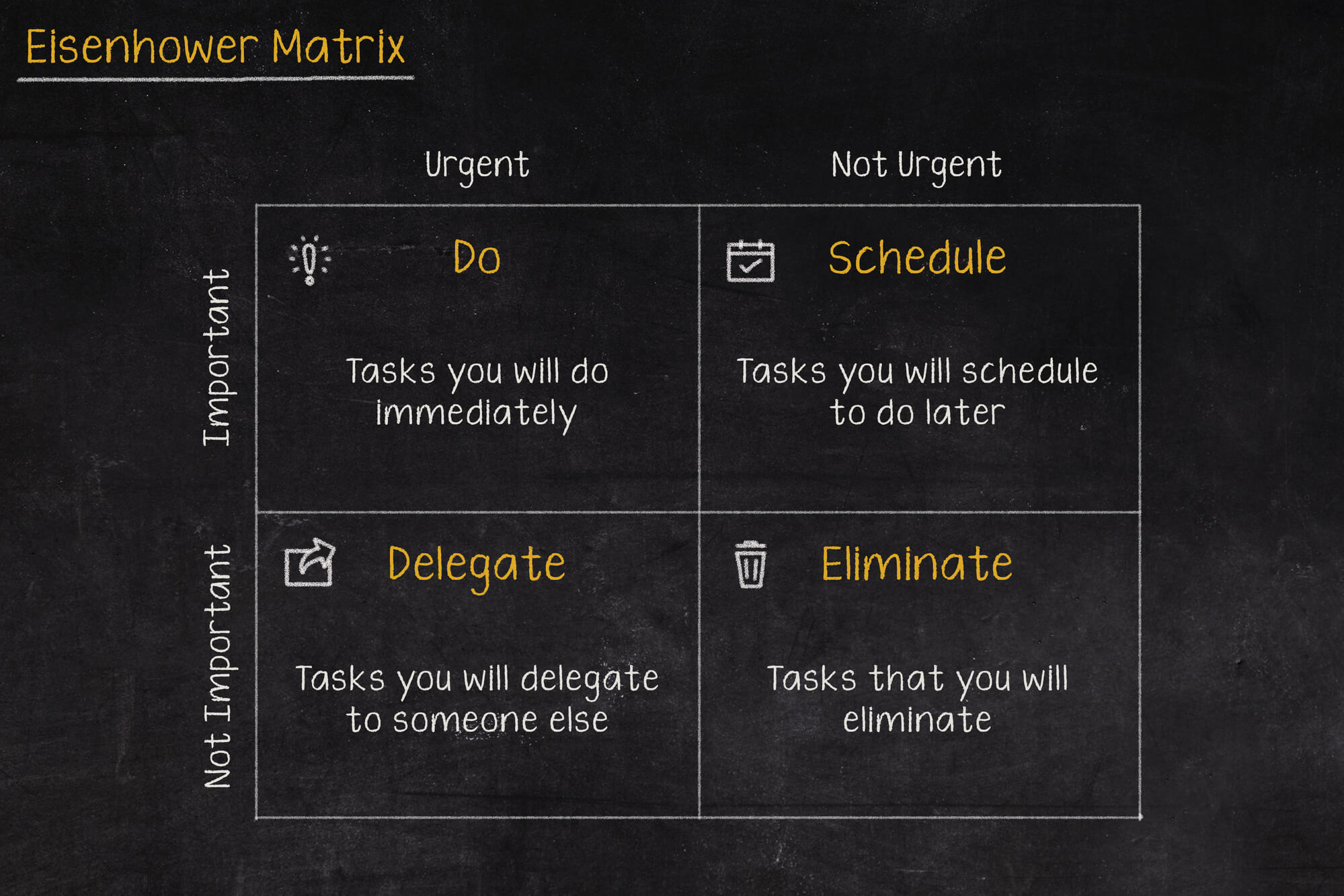

Macierz Eisenhovera, czyli jak zapanować nad priorytetami?

Iść na przerwę a może odpisać na tego maila, czy odebrać telefon od przełożonego? W jakiej kolejności zająć się tymi zadaniami, aby nie utracić nad tym kontroli i nie popaść w bezsilność? Rozwiązaniem tych problemów może być Macierz Eisenhowera (nazywana także Matrycą lub Kwadratem Eisenhowera).

Czy Alert RCB powinien informować o wyborach prezydenckich?

Komunikacja w niebezpieczeństwie jest jednym z ważniejszych zagadnień jakie się porusza podczas żeglowania, latania czy nurkowania. Ostrzeżenia potrafią uratować życie, dlatego nie powinny być lekceważone, a tym bardziej nie powinny swoją treścią prowadzić do ich zignorowania.